Portugal: The new Regime on the Purchase and Servicing of Banking Receivables introduces developments in the credit secondaries market

The new Regime on the Purchase and Servicing of Banking Receivables (RCGCB) has been approved, transposing Directive (EU) 2021/2167 and regulating the assignment and management of credit receivables in Portugal. This measure aims to harmonise the Portuguese secondary debt market with that of other EU Member States, facilitating more competitive transactions and strengthening legal certainty for financial institutions and credit purchasers.

Directive (EU) 2021/2167 of the European Parliament and of the Council of 24 November 2021 on credit servicers and credit purchasers aims to harmonise the Portuguese credit secondaries market for banking credit with the rules applicable in other Member States, creating conditions for a range of entities (especially useful for credit institutions) to transfer positions under more competitive circumstances. Through the new regime on the assignment and servicing of banking receivables, set out in Annex I to Decree-Law 13/2025, of 11 September (DL 103/2025), published today in the Portuguese Official Gazette (RCGCB) the Portuguese legislator sought to transpose the provisions of that Directive into the national legal framework.

In addition to the regulatory impacts – particularly relevant in the context of credit servicing activities – the RCGCB introduces significant practical implications for the credit secondaries market for banking receivables.

Receivables and contractual positions subject to the RCGCB rules

The RCGCB applies to purchases of credits (either through receivables assignment or contractual position transfer of loan agreements) originated by:

- Credit institutions, financial companies, payment institutions, and electronic money institutions with their registered office in Portugal.

- Credit institutions and financial institutions with their registered office abroad and established in Portugal.

- Any of the above entities established in the EU and authorised to grant credit in Portugal under the freedom to provide services regime.

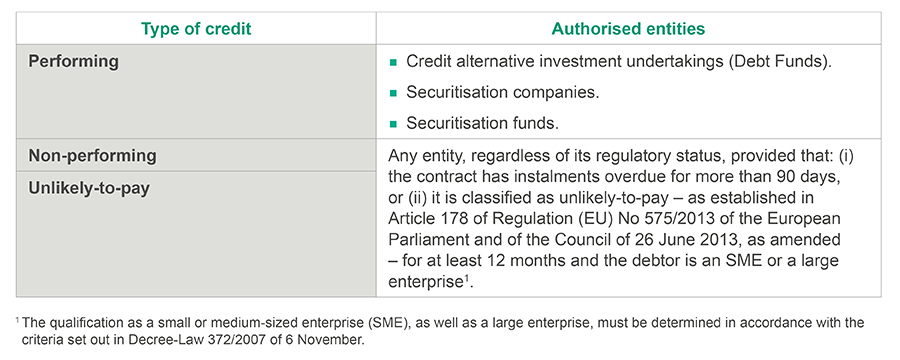

Entities authorised to purchase credits

The acquisition of receivables and contractual positions subject to the RCGCB may be carried out by the following entities:

Contractual impacts on effectiveness of assignment of contractual position of banking loans

The assignment of contractual position of banking term loan and facility agreements subject to the RCGCB does not require debtor consent where the debtor is an SME or a large enterprise, but is subject to:

- the prior appointment of a credit servicer, where applicable. This requirement may be waived when the purchaser of the receivable or contractual position is the servicer itself and intends to assume those functions within the respective transaction; and

- the notification to the debtor within 10 days after the assignment (and always before the first collection), containing the minimum information required under the RCGCB.

Principle of assignment neutrality

The purchaser of receivables or contractual positions becomes subject to the legislation applicable to the receivable or loan agreement under the same terms as the originator (e.g., contractual obligations, consumer protection rules, among others). However, servicers are responsible for ensuring compliance with this principle of assignment neutrality.

Due diligence

To standardise the process of aggregating information on receivables and contractual positions for sale, originators/sellers must use the data templates set out in Commission Implementing Regulation (EU) 2023/2083 of 26 September 2023, which establishes technical implementing standards for the application of Article 16(1) of Directive (EU) 2021/2167 of the European Parliament and of the Council regarding the models to be used by credit institutions when providing buyers with information about their exposures to credit risk in the banking portfolio. Therefore, potential purchasers will have sufficient and standardised information to assess the risks associated with the receivables or positions to be acquired.

Other key points of the RCGCB

Supervision: The Bank of Portugal is responsible for supervising compliance with the rules on the transfer of credits and contractual positions subject to the RCGCB.

Credit servicing: The servicing of credits subject to the RCGCB is now subject to licensing requirements as well as fit & proper assessments. This activity may be carried out on a cross-border basis in various Member States through the European “passport”.

Third-country assignee: If the assignee does not have residence, registered office, or central administration within the European Union, they are required to appoint a representative with residence, registered office, or central administration in a Member State, who will act as the point of contact with the Bank of Portugal and be responsible for complying with the obligations arising from the RCGCB.

GDPR: Originators/assignors, assignees, and managers are required to comply with rules relating to the processing of personal data in the context of transactions covered by the RCGCB, being responsible for fulfilling duties regarding information, access, rectification, objection, and deletion of data.

Administrative offense regime: Non-compliance with certain rules set out in the RCGCB may constitute administrative offenses, which can be sanctioned by the Bank of Portugal through fines and ancillary penalties.

Entry into force: 90 days after the date of its publication.

Temporal application: Without prejudice to the general rules on entry into force, certain provisions apply by reference to receivables originated prior to the publication of the RCGCB, namely:

- the principle of assignment neutrality applies to receivables whose initial assignment took place on or after 30 December 2023; and

- the requirement to use the data templates set out in Commission Implementing Regulation (EU) 2023/2083 of 26 September 2023 applies to transfers in respect of receivables originated on or after 1 July 2018 which became non-performing exposures after 28 December 2021.

Other key points of DL 103/2025

Securitisation of banking receivables:

- Effectiveness of the assignment – Similarly to the mechanism set out in the RCGCB, the securitisation of receivables subject to the RCGCB requires (i) the appointment of a servicer and (ii) notification to the debtor within 10 days after the assignment (and always before the first collection).

- Sale of performing receivables – It is now expressly permitted to sell performing securitised receivables to Debt Funds, aligning the Securitisation Regime (as approved by Decreto-Lei n.º 453/99, de 5 de novembro, as amended) with the Portuguese Collective Undertakings Regime (as approved by Decreto-Lei n.º 27/2023, de 28 de abril, as mended) and the RCGCB.

Central Credit Register

Access to the Central Credit Register is extended to (i) debt funds, (ii) crowdlending operators, and (iii) servicers authorised under the RCGCB (for the purposes of credit renegotiation).

Contacts