Latest COVID-19 related regulations and policies in China

China -

China Corporate Commentary

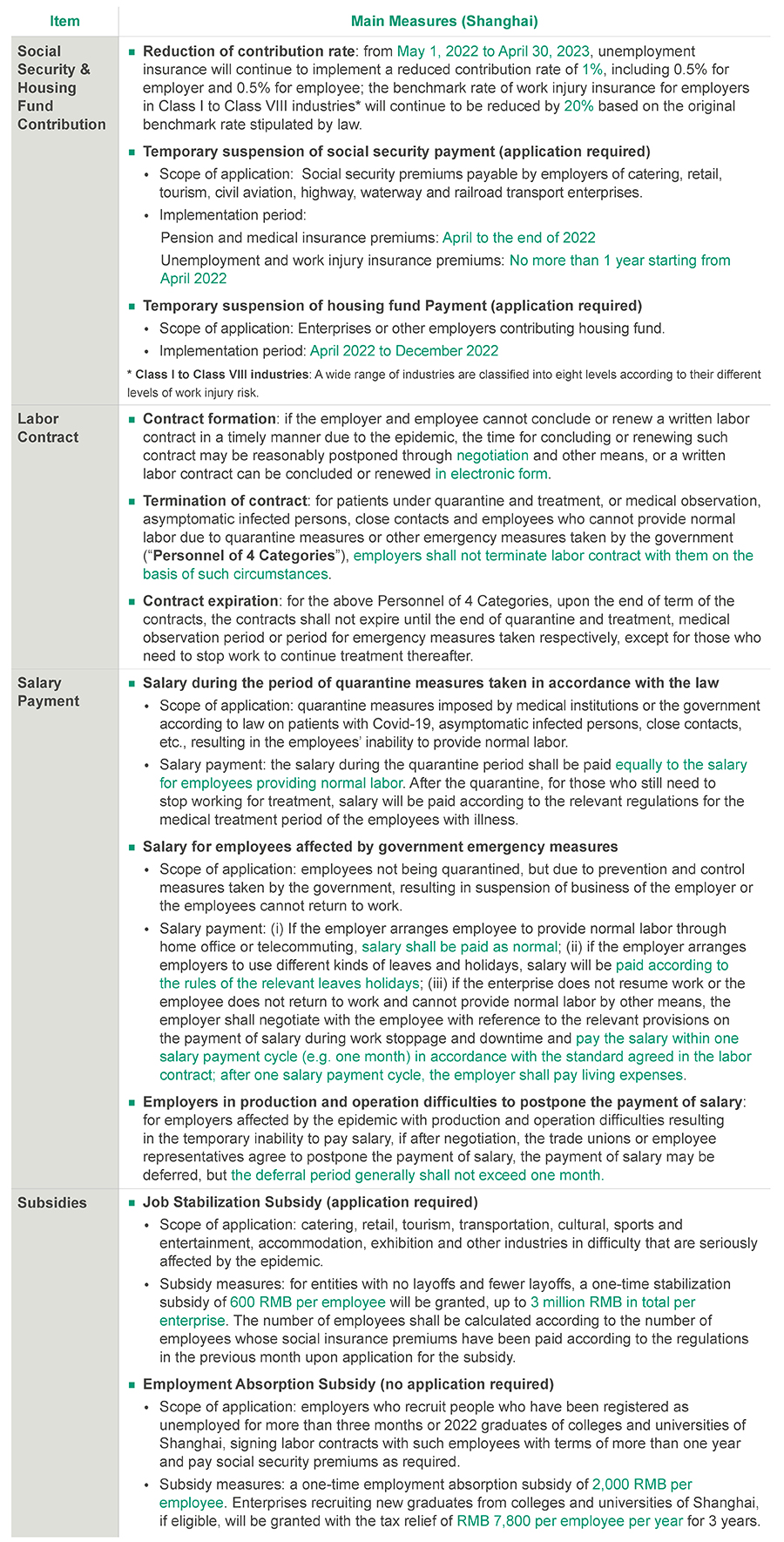

Due to the ongoing situation of COVID-19 in China, especially in Shanghai, the Chinese government has introduced more regulations and policies or extended the deadline of the previously issued regulations and policies to further support both the economic development and the business. In this article, we will share with you detailed provisions of these policies in Shanghai focusing on the topics of labor and employment, leasing, tax, etc. Depending on the location of your business, there could be more specific implementation rules at local level.

Legal - Labor & Employment

Regulations and Policies (Shanghai, updated until May 31, 2022)

- Shanghai Higher People's Court (Shanghai HC), Shanghai Human Resources and Social Security Bureau (Shanghai HRSSB): Answers to Several Questions on Handling Labor Disputes Involving Epidemic Situation

- Shanghai HRSSB: Work Guidelines on Further Maintaining Harmonious and Stable Labor Relations in Current Situation (Hu Ren She Guan [2022] No. 89)

- Shanghai HRSSB: Notice of Shanghai HRSSB and Other Four Departments on the Phased Implementation of Deferring Payment of Enterprise Social Security Premiums in Difficult Industries (Hu Ren She Gui [2022] No. 15)

- Shanghai HRSSB, Shanghai Finance Bureau and State Taxation Bureau of Shanghai: Notice on Continuing the Phased Reduction of Social Security Premium Rates for Urban Employees (Hu Ren She Gui [2022] No. 13)

- Shanghai People’s Government: Action Plan for Accelerating Economic Recovery and Revitalization of Shanghai (latest release, effective from June 1, 2022)(“Action Plan”)

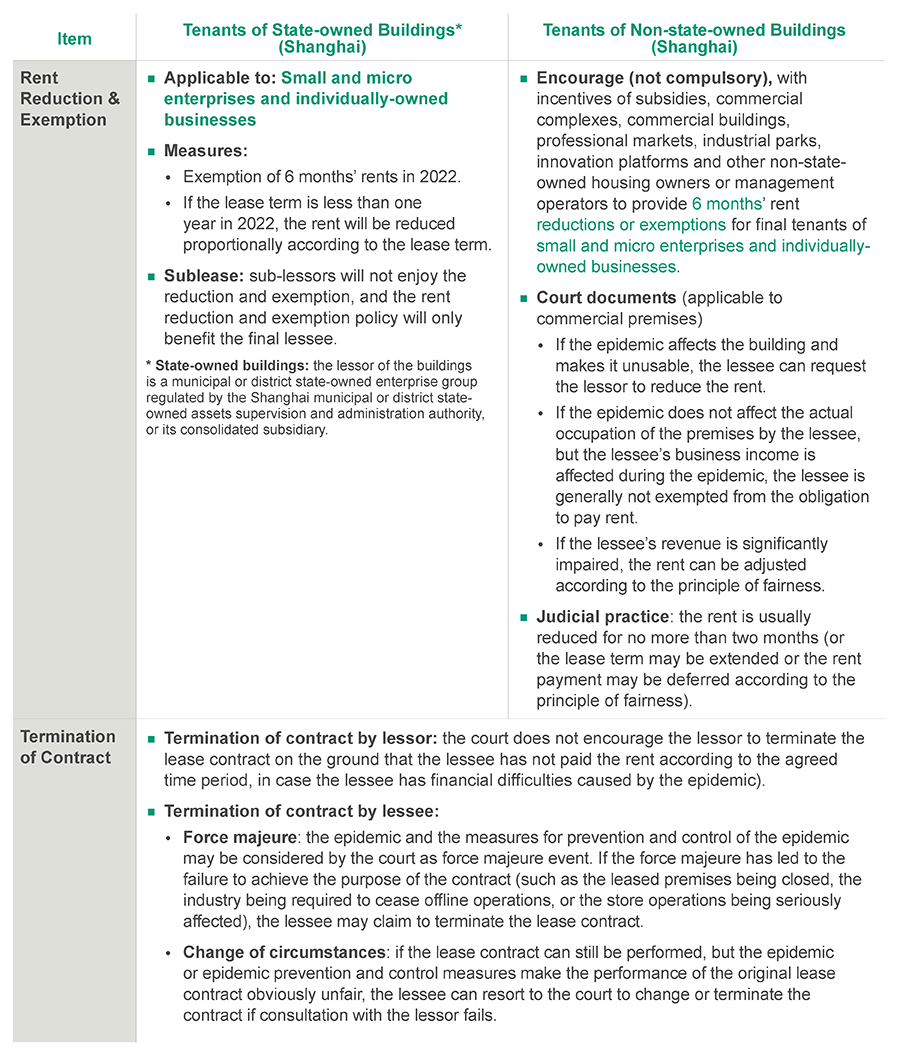

Legal - Leasing

Regulations and Policies (Updated until May 31, 2022)

- National Development and Reform Commission and other departments: Several Policies on Promoting the Resumption of Development of Difficult Industries in the Service Industry (Fa Gai Cai Jin [2022] No. 271)

- General Office of Shanghai Municipal People's Government: Several Policies and Measures for Shanghai to Fight against the Epidemic with All Efforts to Help Enterprises and Promote Development (Hu Fu Ban Gui [2022] No. 5)

- State-owned Assets Supervision and Administration Commission in Shanghai, Shanghai Housing and Urban-Rural Development Management Commission, Shanghai Housing Administration Bureau: Implementation Rules for Shanghai State-owned Enterprises to Reduce and Remit Housing Rent for Small and Micro Enterprises and Individually-owned Businesses

- Shanghai HC: Series of Questions & Answers on the Application of Law in Cases Involving the Epidemic Situation

- Shanghai People’s Government: Action Plan (latest release, effective from June 1, 2022)

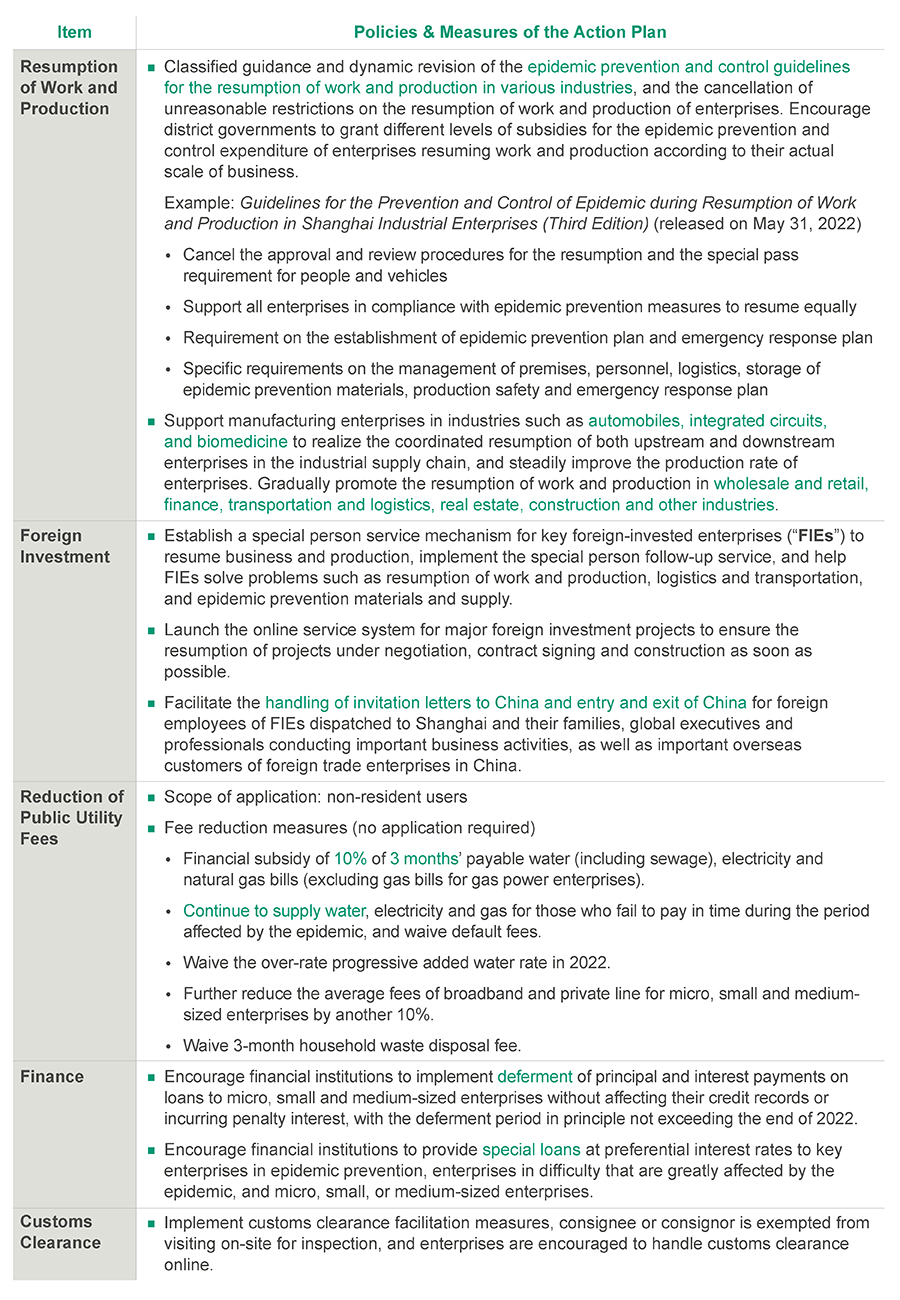

Legal – Other Supporting Measures of the Action Plan (Implementated from June 1, 2022 to December 31, 2022)

Tax

- Residents and non-residents in Shanghai: 2021 Annual Enterprise Income Tax filing deadline is extended to June 30, 2022.

- Tax credit rating results in Shanghai: the date for results of tax credit rating for 2021 is extended to be announced on May 31, 2021.

- VAT exemption for small-scale VAT payers: applicable for the VAT liability arises in the period from April 1, 2022 to December 31, 2022.

- VAT super deduction (10%) for manufacturing and life related service industry (i.e. Postal services, telecommunication services, modern services and life services): the applicable period is extended to December 31, 2022.

Contacts

-

+34 95 207 55 25