What are ECPs, and whom do they affect?

Although the Act on Employee Capital Plans came into force on 1 January 2019, businesses still have time to make preparations for when the new laws take effect.

Above all, ECPs are intended to be an incentive for voluntary, long-term savings, with a pension and option of withdrawal of the accrued funds before the term ends in mind. Obviously, ECPs are intended for employees’ benefit, but the parties responsible for accumulating capital together with the employee will be the employer and the state.

Applicability

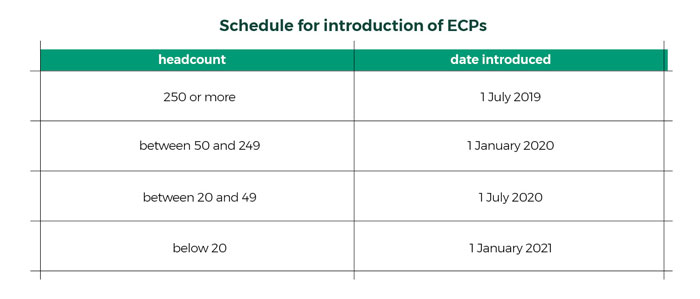

In the first group of businesses affected, which are those with a headcount of more than 250, ECPs will be introduced on 1 July 2019, while the next groups will join the scheme over the period up until 1 January 2021.

ECPs are intended to apply to all employees who are subject to compulsory retirement and disability pension insurance. This means that persons working on a freelance basis, those who are self-employed, and those who operate sole proprietorships with at least one employee, are also covered. ECPs will not however apply to sole proprietorships that do not have any employees.

The voluntary nature of ecps

Joining an ECP is voluntary, but under the law any person in work aged between 18 and 55 is registered for an ECP automatically.

Participation is voluntary because it is based on an “opt-out” system, which requires an employee to serve unilateral notice in writing if they prefer not to join the ECP. An employee will be required to serve opt-out notice every four years, otherwise they will be reregistered in the ECP.

Contributions

Savings accrue on a basic deposit of 2% of the gross salary contributed by the employee, and 1.5.% of gross salary contributed by the employer. It will be possible to lower the basic deposit even to 0.5% of gross salary, if the salary is equal to or less than 120% of the minimum wage. Also, both the employee and the employer can make additional deposits of a maximum, consecutively, of 2.5% and 2%. The automatic level of the total contribution will therefore be solely up to the employee and employer, and may be between 3.5% and 8% of the gross salary. The state’s share in employees’ accrued savings translates into a one-off starting deposit of PLN 250 to an employee’s individual ECP account and an annual payment of PLN 240 to the ECP account.

The employer’s obligations

Under the ECP Act, employers have a range of new obligations, the most important of which is of course setting up the ECP. For this reason, an employer will be required, in consultation with the company trade union, and if there is no trade union, in consultation with persons representing the people employed, to conclude an ECP management agreement with the authorised institution. The authorised institutions will include investment funds managed by investment fund management companies, pension funds managed by general pension management companies or employee pension companies, and insurance companies. The next step for an employer to set up an ECP will be signing an ECP agreement. An employer could face criminal liability and a fine for not signing an ECP management agreement and not operating an ECP.

Withdrawal of the accrued funds

Lawmakers insist that the aim of an EPC is that funds on an individual account should not be withdrawn until the age of 60, for both men and women. At that time, an employee will be able to decide whether to continue to save under the EPC, or withdraw the funds.

It will not be possible to transfer all of the funds at once. It will be possible to withdraw at one time 25% of the accrued funds, and the remaining 75% in monthly payments over a period of ten years (120 payments). A withdrawal made in this way will be exempt from the Belka capital gains tax. Participants in an ECP will be required to pay personal income tax at a flat rate of 19% only if a request is made for withdrawal of 75% of the remaining funds in fewer than 120 payments..

Under the act, it will also be possible to withdraw a portion of the ECP funds early, for example if an ECP participant suffers from a serious illness or takes out a mortgage.

An ecp and implications for employers and employees

The ECP Act will probably not go unnoticed by businesses. Apart from the new obligations of employers due to introduction of an ECP, this will certainly mean that employment costs go up as well.

On the other hand, the changes discussed above might be beneficial for employees above 55 years of age. As a result, 55+ employees can be expected to be more competitive on the job market.

Contacts