VAT Law Enacted: New Stage of China's VAT Legislation

After rounds of public consultation, the Value Added Tax Law of the People's Republic of China was announced on 25 December 2024 and will be effective from January 1, 2026. As one of the most important type of taxes in China, it is a remarkable milestone of the legislative process in China.

Value added tax (VAT) has been levied in China on the sales of goods, processing and repair services since 1994 and evolved over time. Effective from 1 May 2016, the publication of Circular on Comprehensively Promoting the Pilot Program of the Collection of Value added Tax in Lieu of Business Tax (Circular 36) announced the end of business tax, which has been replaced by VAT and is imposed on the sales of services, intangible assets and non-moveable property. Over the years, a series of VAT-related rules and regulations have been enforced and updated. Notwithstanding, from the perspective of the hierarchy of legal effectiveness, VAT has not been legislated until the publication of the Value Added Tax Law of the People's Republic of China (VAT Law).

Major Changes between VAT Law and Current Prevailing Rules and Regulations

Certain clauses have been modified, added or removed in the VAT Law in comparison with: (a) Interim Regulations of the People's Republic of China on value-added tax (revised in 2017) (VAT Regulation); (b) Implementing Rules for the Interim Regulations of the People's Republic of China on Value Added Tax (revised in 2011); and (c) Circular 36.

The changes in context might impact the tax position of taxpayers. The major changes are highlighted and summarized in the following.

- Scope of Domestic Taxable Transactions for Sale of Financial Products, Services and Intangible Assets

- Revised Scope of “Deemed Sales”

The concept of “deemed sales” is now technically renamed as “deemed taxable transaction” in the VAT Law. The VAT Law has excluded certain scope of “deemed sales” from the “deemed taxable transaction”.

- Scope of Non-taxable Transactions

Article 6 of the VAT Law specifically includes the scope of non-taxable transactions with four circumstances, among which three circumstances are included in Circular 36. In the case that a transaction or an event neither falls into the scope of taxable transactions, deemed taxable transactions nor the four circumstances of non-taxable transactions, the doubts on whether such transaction or event is taxable would arise, unless the interpretation to Article 6 would be issued by the competent government authority. Otherwise, the competent tax authority of the taxpayer may have its own interpretation and discretion in practice.

- Simplified Taxation Method

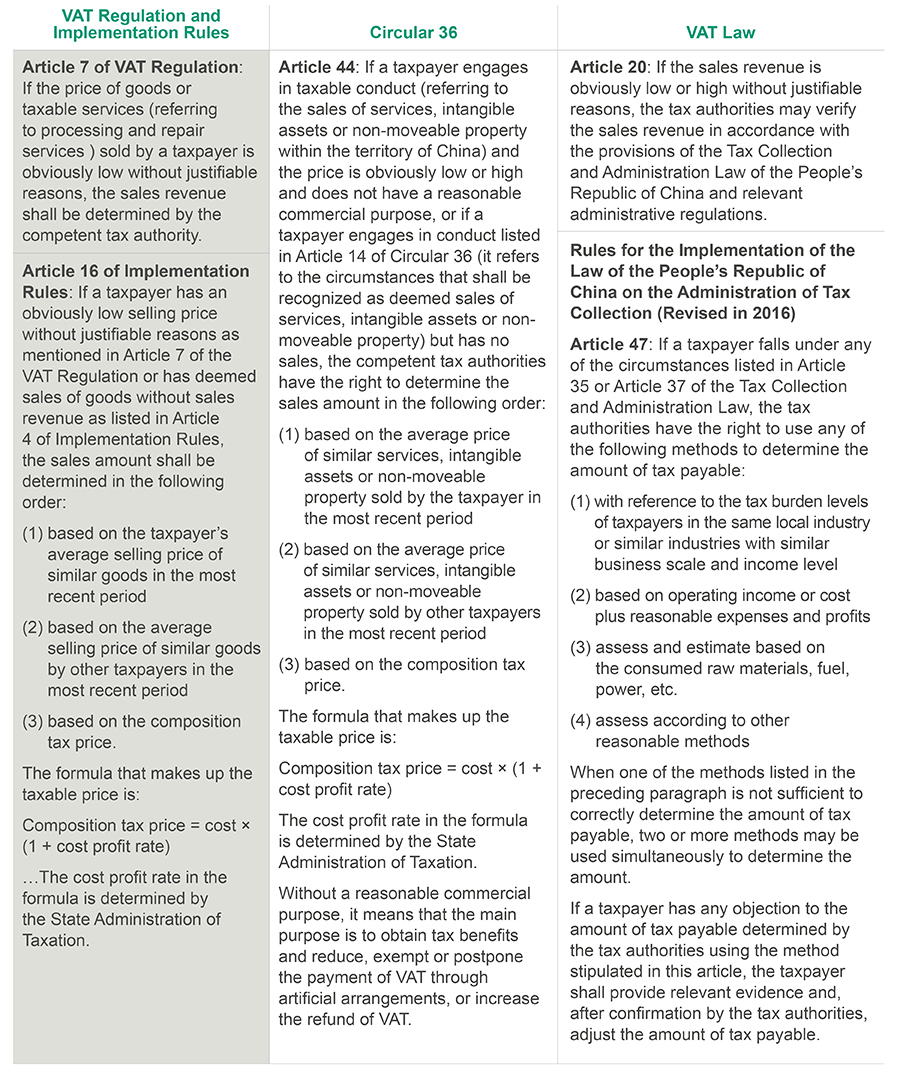

- Assessment of the Sales Amount

As compared in the below table, the VAT Law includes the right of adjustment on selling price by the competent tax authorities in the circumstances of the selling price is considered either obviously low or obviously high for all taxable transactions. The VAT Law fills the gap of the VAT Regulation, which only allows the tax authorities to adjust the selling price of goods or taxable services if the price is obviously low.

The VAT Law also unifies the criterion for price adjustment as “without justifiable reasons”. Nevertheless, the definition of “without justifiable reasons” continues to be left in blank. The competent tax authority of the taxpayer may have its own interpretation and discretion in practice.

In addition, the assessment methods to be carried out by the tax authorities would be different from the Implementation Rules and the Circular 36. Taxpayers shall pay special attention to the change in assessment methods.

- Non-deductible Input VAT Credit

Compared with the VAT Regulation and Circular 36, Article 22 of the VAT Law removes the input VAT corresponding to purchasing loan services from the scope of non-deductible input VAT. However, it has a fallback clause of “other input VAT as stipulated by the State Council”, which allows further legislation on the tax treatment for input VAT obtained from purchasing loan services.

Another minor change lies in the input VAT obtained from purchasing and directly consumed in catering services, daily services for residents, and entertainment services. The change might indicate that purchasing the listed services without direct consumption (e.g. purchasing the food and beverage vouchers as gifts to clients by entities) would allow the corresponding input VAT to be deducted under general taxation method.

- Other changes

Other changes in VAT Law in comparison with the prevailing rules and regulations include but not limit to:

- Overseas entities or individuals who has conducted VAT taxable transactions within China, the purchaser shall be the withholding agent, or a domestic agent could be entrusted by the overseas entities or the individuals to settle the tax declaration and payment

- Change of filing period: the 1st day, 3rd day, and 5th day declaration period has been removed

- Legislation of input VAT refund policy: the current VAT preferential policy of tax refund for excessive input VAT credit in a certain period has been officially included in the VAT Law

Summary

By comparing the changes between VAT Law and aforementioned rules and regulations, we expect that the competent government authorities at the state level would announce more publication for clarification of doubts in the VAT Law or update the prevailing regulations and rules for consistency purpose before the VAT Law becomes effective. We will keep a close eye on the development of VAT. Meanwhile, taxpayers are suggested to pay special attention to the changes in VAT Law and the possible impact on the business operation.

Contacts