Mexico: New fees for concentration analysis come into force

The National Antitrust Commission (CNA) implemented a new tariff scheme for the procedure to analyze concentrations in Mexico, replacing the traditional fixed quota and establishing a tiered fee system based on the maximum value of the reviewed operation. This measure implies a significant increase in the applicable fees and introduces new obligations for notifying agents.

On December 19, 2025, the National Antitrust Commission (CNA) published the agreement setting the fees for the services provided by the CNA, pursuant to the Twentieth Transitory Article of the Decree reforming the Federal Economic Competition Law.

This agreement, which entered into force on the same day it was published, contains the cost of those services the CNA charges for, which include: issuance of copies, comparison of documents, issuance of certifications, and analysis of concentration notifications.

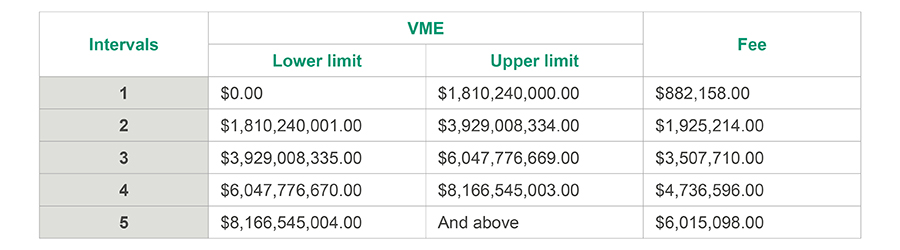

Historically, the economic competition authority in Mexico considered a single fee for the analysis of concentrations, which was calculated using the Measurement and Update Unit (UMA) and increased annually in accordance with the variation of said UMA. However, this new Agreement provides that, in order to determine the fees that agents must pay to the CNA prior to the analysis of the concentration, it is necessary to consider a concept called “Maximum Estimated Value” (VME) of the transaction, in accordance with the following:

These rates exclude the corresponding Value Added Tax in force, which currently stands at 16%.

The agreement includes a fairly extensive section of recitals, which describe various reasons for the considerable increase in fees, among which the CNA mentions: (i) adherence to international practices of other authorities in charging tiered fees; (ii) the amount of resources invested in analyzing the various concentrations presented by economic agents, and (iii) a 15% “sustainability factor” following practices such as those of the Canadian and US authorities.

This new methodology represents an increase of around 272% of the base rate in comparison with the fixed amount established in 2025, which increases in accordance with the corresponding VME.

It is also important to consider the following:

- Notifying agents must justify, under oath, the reasoning behind their estimate of the VME for their transaction in the notification filed before the CNA.

- The CNA has the authority to formally request any clarification regarding the VME calculated by the agents.

- If the CNA determines the VME was incorrectly calculated: (i) no refund will be made if the estimate was higher than the actual value of the transaction; and (ii) the CNA may require agents to pay the corresponding additional amount if the calculated VME is lower than the actual value of the transaction.

This implies not only an increase in the payment of fees, but also the imposition of an additional obligation to notifying agents, which must be duly substantiated and detailed in the submitted notification and which could also entail the payment of surcharges and adjustments in accordance with the Federal Tax Code if the correct payment is not made in a timely manner.

Those affected by the content of the agreement may file an indirect amparo lawsuit alleging violations of rights and principles established in the Mexican Constitution. Said remedy must be filed within 15 business days from the date on which a specific impact resulting from the Agreement materializes.

Contacts

-

+52 55 5029 8500

-

+52 55 5029 8500

-

+52 442 296 6400

-

+52 55 5029 8500

-

+52 55 5029 8500

-

+52 55 5029 8500

-

+52 55 5029 8500