Wealth tax renewed for 2020 and other tax measures

Spain Tax Alert

On December 27 the council of ministers approved Royal Decree-Law 18/2019 (published in the Official State Gazette on December 28 and in force a day later) adopting tax and cadastral measures along the same lines as in previous years.

The following measures have been introduced:

a) Wealth tax: it is known that Royal Decree-law 13/2011 temporarily reinstated wealth tax for fiscal years 2011 and 2012, after it had been eliminated in practice since 2008, through a 100% reduction. This regime has been renewed every year and has now been renewed for 2020, so the 100% reduction will not be applicable (in principle) until 2021. It should not be forgotten, however, that this is central government legislation and that a few autonomous communities have used their legislative powers to allow specific reductions. Therefore, the applicable legislation for the relevant autonomous community of residence must be taken into account.

b) Personal income tax and VAT: the quantitative limits determining the scope of the personal income tax objective assessment regime and the simplified and special VAT schemes for agriculture, livestock and fishing have been renewed for 2020. Simultaneously a new time limit has been set for filing waivers or revocations in relation to these special methods and regimes or schemes, which will come into effect in 2020. This time limit will be one month running from December 29, 2019. Waivers and revocations submitted for 2020 in December 2019 will be deemed timely submitted, although changes to them are allowed to be made within this same one-month time limit.

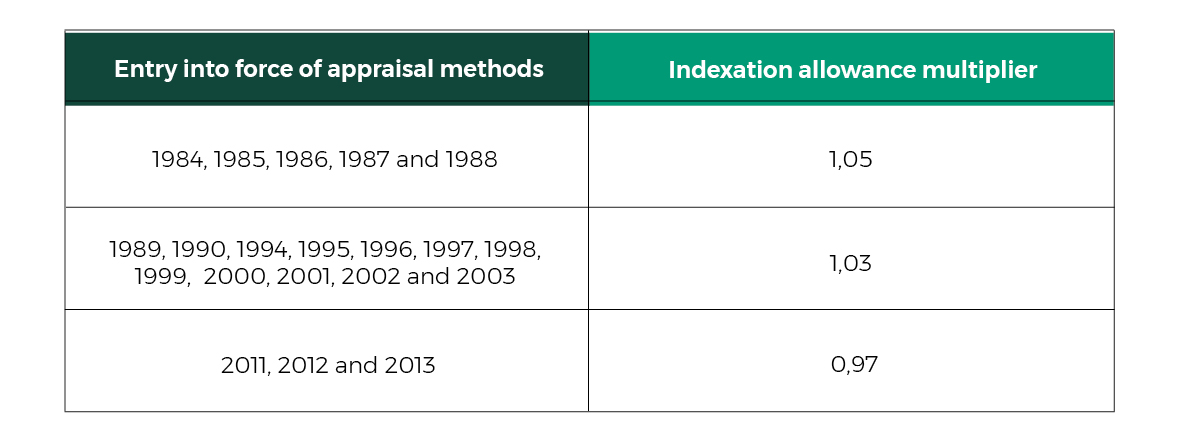

c) Real estate tax: as happens every year, the indexation allowance multipliers applied to cadastral values have been set for 2020 along with the rules for applying those multipliers. These multipliers are now as follows:

d) Priority patronage activities: the priority patronage activities in 2020 are those listed in additional provision seventy-one of Law 6/2018 of the General State Budget Law for 2018. For these activities, as in previous years, the tax credit rates and limits established in Law 49/2002 will be raised by five percentage points.

Contact