Spanish insolvency pre-pack new feature: appointment of a silent administrator

Spain Restructuring & Insolvency Commentary

The judges of the Commercial Courts of Barcelona have released a set of basic guidelines for conducting Spanish insolvency pre-packs in that forum, by introducing the feature -of optional use- of the silent administrator. The guidelines were approved in the context of a seminar organized on January 20th.

This process aims at the realization of the assets of a distressed company prior to the beginning of insolvency proceedings, at the initiative of the debtor and with the supervision of a so-called silent administrator appointed by the Court. Such silent administrator is to be subsequently appointed insolvency receiver should the insolvency proceedings of the debtor be eventually opened in order to execute a business sale.

The sale of businesses (or “productive units”) within Spanish insolvency proceedings has proven over the years that the timeframes linked to this sort of process are not always compatible with the maintenance of the workforce, asset value and activity of the business.

In turn, business sales proposed by debtors to insolvency courts and receivers are often distrusted, as the latter have not had the opportunity to scrutinize whether the sales process has been conducted with transparency, publicity and real competition between potential bidders. The appointment of a silent administrator ahead of the opening of the insolvency proceedings introduces a mechanism that allows to eradicate such mistrust problem.

Pre-packs are deemed aligned with the rationale and purpose of the Directive (EU) 2019/1023 of the European Parliament and of the Council of 20 June 2019 on preventive restructuring frameworks as they contribute to the shortening of the length of insolvency proceedings and thus favor the recovery rates within them. Moreover, Spanish pre-packs fall within the scope of the European Insolvency Regulation and so they benefit from its automatic recognition throughout the rest of EU Member States.

In lack of an express legal regulation on the matter in Spain, what follows are the main guidelines concerning insolvency pre-packs as recently released by the Commercial Courts of Barcelona:

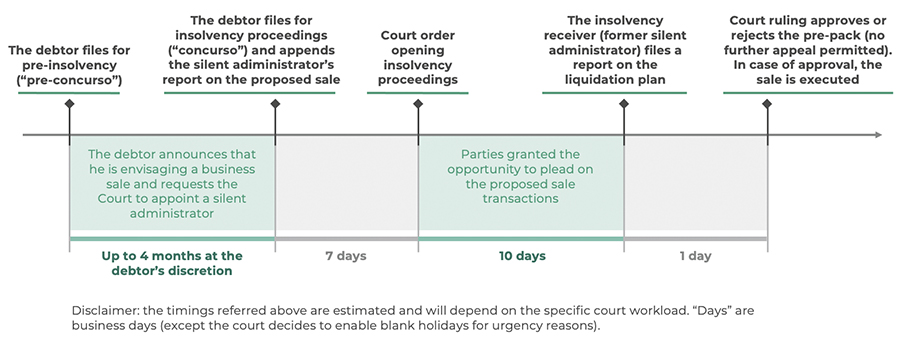

1. Content of the request for the appointment of a silent administrator

A debtor may ask for a 4-month moratorium or protective shield against creditor enforcement and directors’ liability (pre-concurso). The debtor may (i) exhaust that 4-month period; or, at any given moment, (ii) emerge from the moratorium by fixing its problems (for instance, by means of a refinancing agreement) or (iii) file for fully-fledged insolvency proceedings (concurso). However, without prejudice of the directors’ duty to file for insolvency, the opening of insolvency proceedings is not automatic after the pre-concurso period has elapsed and is left to the debtor’s decision.

In the writ communicating the pre-concurso to the competent court (or in a subsequent writ), the debtor may state that he is envisaging certain transactions over its assets (either the whole business or certain of its productive units). And the novelty now consists in that the debtor may also request the appointment of a silent administrator.

In order for this request to be admitted, it shall append the following documents:

- A proof of submission of the standard virtual form which can be found in this link.:

- A list of competing companies with the debtor as well as a list of investors with whom the debtor has contacted -or commits to contact- throughout the process.

Moreover, the debtor must commit to inform its potential bidders of the existence of a so-called register of interested parties where they may enroll (check here).

2. Out-of-court phase of pre-pack with silent administrator

This first phase, whose aim is to envisage and prepare the relevant sale transactions, may be declared confidential if so requested by the debtor.

The silent administrator shall be subject to the rules set forth in the Spanish insolvency regulation on the appointment and liabilities regime of insolvency receivers.

The silent administrator shall respect the powers of management and administration of the debtor, who will remain in possession during pre-concurso.

The remuneration of the silent administrator shall be paid by the debtor if its insolvency proceeding is eventually not opened.

In this stage, the tasks to be carried out by the silent administrator shall be the following:

(i) To assist and supervise the debtor in the preparation of the relevant sale transactions on the company's assets;

(ii) To become acquainted with the debtor’s business;

(iii) To inform the creditors about the process, participating -where appropriate- in the negotiations, especially with privileged and public creditors, as well as with the workers' representatives;

(iv) To verify and supervise the publicity and transparency in the preparation of sale transactions on the company's assets, especially by ensuring equal access to the same information and opportunities among interested parties;

(v) To issue a final report on the tasks carried out and, in particular, on the sale transactions envisaged and prepared.

The mentioned final report shall feature an impartial and independent assessment on items such as: (a) the publicity of the process; (b) the information provided to the different parties; (c) the existence of actual competition; (d) whether the bids obtained do match the minimum price to be expected in the circumstances of the case; (e) whether any bidder (financial or industrial) has extended credit in order to maintain the business as a going-concern; and (f) a forecast of the evolution of the business once the insolvency proceedings are opened and in the event that the envisaged sale transactions are not eventually implemented.

3. In-court phase of pre-pack with silent administrator

Once the debtor files for the opening of formal insolvency proceedings (concurso), the debtor shall moreover append the final report issued by the silent administrator in case he wishes to proceed with the projected sale.

Through the Court ruling by which insolvency proceedings commence, creditors and any interested parties shall be granted a 10-day term to file any pleadings they deem convenient regarding the proposed sale transactions.

Once such term elapses, the insolvency receiver shall issue a new report on the liquidation plan proposed by the debtor with its insolvency filing. On the day after, the court shall issue a ruling taking a decision either approving or denying the proposed sale transactions. This ruling shall not be subject to any appeal.

Once the ruling is firm, the insolvency receiver will immediately proceed to execute the approved transactions.

4. Time-line of the pre-pack with silent administrator

Contacts