China’s first attempt for Advance Tax Ruling: trail implementation in Shanghai

Shanghai introduces a trial Advance Tax Ruling (ATR) system, a significant step in China's tax administration. ATR, common in countries like Spain and the U.S., allows enterprises to seek formal tax opinions on future complex tax matters, enhancing certainty. The ATR applies to corporate taxpayers in Shanghai, though its applicability to non-resident taxpayers is subject to further confirmation with the in-charge tax authority.

On December 29, 2023, the municipal tax authority of Shanghai has issued Measures of Shanghai Municipal Taxation Bureau for the Administration of Advance Tax Ruling (for Trial Implementation) (Measures), marking a significant step of increasing certainty on future taxable or non-taxable events rather than solely relying on post administration on tax matters.

Advance tax ruling (ATR) has been implemented in many countries, such as Spain, United States, France, New Zealand, Singapore, etc. Despite Chinese Customs having been enforcing advance customs ruling services for years, for general tax matters apart from advance pricing arrangement, so far there has been no enacted rules and regulations stipulating ATR. It is a further development of tax administration in China.

Purpose of the Measures

The Measures intend to improve tax certainty, as well as providing guidelines for implementation procedures of ATR.

Definition of ATR

ATR refers to the tax authority providing tax ruling services based on the principle of mutual trust between tax authorities and enterprises, where enterprises make applications on how to apply tax laws and regulations to specific complex tax-related matters that are expected to occur in the future, and the tax authority provides a formal written “Advance Tax Ruling Opinion” based on current tax laws and regulations, etc.

Applicants and scope of ATR

The Measures apply to corporate taxpayers in Shanghai. As the Measures are newly introduced, whether the non-resident taxpayers would be recognized as an applicant need to be further communicated with the tax authority. We understand that corporate taxpayers including resident taxpayers and non-resident taxpayers[1], whose in-charge tax authority is in Shanghai. Please note that where there are two competent tax authorities involved in one case, if one of the competent tax authority is not in Shanghai, the Measures may not apply.

While it does not explicitly list applicable situations, certain matters have been excluded from the scope of ATR:

- There are uncertain project plans or events that will not occur within two years;

- Matters that do not have reasonable commercial purposes or are expressly prohibited by relevant national laws and regulations;

- Current tax laws and regulations, etc. that have clear provisions and relevant provisions can be directly applied to the tax matters;

- Other matters to which advance ruling is not applicable.

Kindly note that the Measures specify that advance pricing arrangement shall be governed by international taxation administration department and shall follow the relevant procedures for advance pricing arrangement, which is excluded from the scope of ATR.

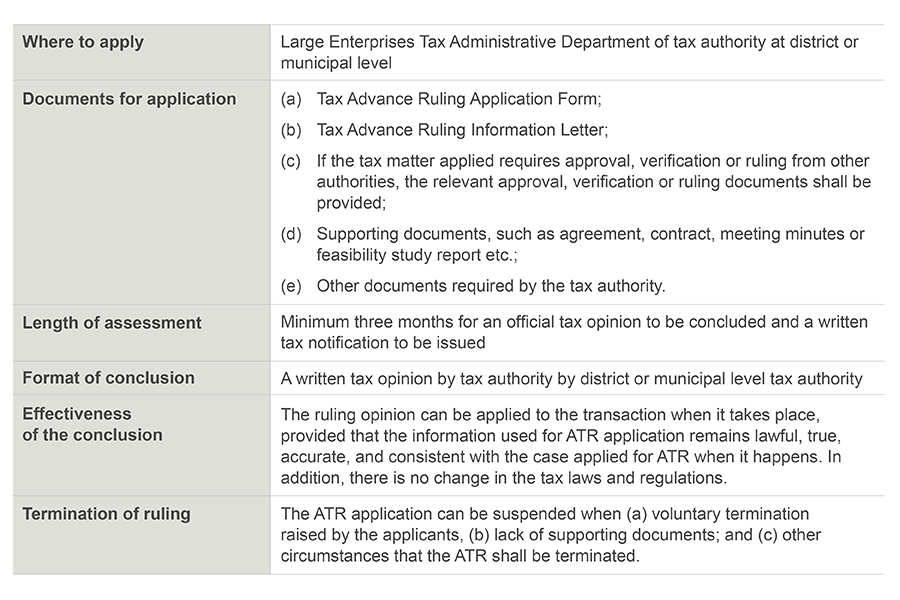

Formalities

Please note that (1) despite the name of the in-charge department, the applicant is not limited to large enterprises only for ATR; (2) the conclusion of ruling is only applicable to the applicant and the envisaged tax matters applied for. The ruling may not be applied to other applicants and other similar cases.

Garrigues comments

In the past few years, the Chinese tax authority has undertaken a transformation from approval mode to self-assessment mode on certain tax matters. Taxpayers shall assess their own status for tax filings or record filing for tax benefits, such as tax exemption, tax deferral or treaty benefit application etc. The tax authority would carry out future tax administration on the tax matters. In practice, some competent tax authorities would involve in the pre-assessment of whether the taxpayer is eligible for a certain tax benefit before the taxpayer applies for such record filing. In other words, such application usually obtains the verbal approval of the competent tax authority after rounds of communication with the taxpayer. Nevertheless, the competent tax authority would not issue any written notice to secure the verbal approval. In other cases, taxpayers apply the record filing for tax benefits directly and wait for the future tax administration. Either method has potential tax risk of uncertainty in complex tax matters, in particular, international taxation, such as cross border restructuring or indirect transfer of taxable properties in China, assessment of beneficial owner etc.

It is not stipulated in the Measures that the written tax opinion by tax authority by district or municipal level tax authority is legally binding to the tax authority or the taxpayer. However, as mentioned in the effectiveness of conclusion above, the ruling is confirmed to be applicable, as long as the conditions are met. It would increase the certainty in complex tax matters to the taxpayer before implementation, which allows the taxpayer to share their own tax opinions to the tax authority and obtains concrete feedback from the tax authority in writing.

It also potentially serves as a model for future implementations in other regions across China to achieve certainty and consistency in tax matters nationwide.

Garrigues will continue to pay attention on development and implementation of the ATR. Our tax professionals have extensive experience in dealing with Shanghai tax authorities for different types of tax matters. Please do not hesitate to contact us if you have any questions or needs.

[1] Non-resident taxpayers could be the taxpayers of the competent tax authority in Shanghai in certain cases, such as outbound remittances of non-trading payments (e.g. service fee, royalty fee, dividends etc.), constituting a permanent establishment in Shanghai, and cross border restructuring or indirect transfer of taxable properties in China etc.

Contacts