COVID-19: ATCUD code only in 2023 and new postponement of tax obligations

Portugal Tax Alert

Following the withdraw of the Proposal of the State Budget Law for 2022 (SBL 2022), the Portuguese Government has administratively approved some of the measures contained in that Bill by Order no. 351/2021-XXII, of 10 November, and Circular Letter no. 30243, of 11 November 2021. In addition, it has once again extended the deadlines to comply with some tax obligations, as occurred in the context of COVID-19 outbreak.

ATCUD and QR Codes

As previously informed, with the approval of Decree-Law no. 28/2019, of 15 February, it was initially foreseen that invoices and other tax relevant documents would, as from 01/01/2020, contain a two-dimensional bar code (QR code) and a unique document code (ATCUD).

This measure was later regulated by Ministerial Order 195/2020, of 13 August, which postponed its implementation to 01/01/2021, and which was again postponed to 01/01/2022 by Dispatch 412/2020.XXII to correspond to the technical difficulties reported by companies to the Portuguese Government.

The 2022 POE proposed the suspension in 2022 of the adoption of the ATCUD code, which is now confirmed by said Order no. 351/2021-XXII, of 10 November, and Circular Letter no. 30243, of 11 November 2021.

As a result, the adoption of the ATCUD code will only become mandatory from 01/01/2023 onwards. It should be noted that the Portuguese Government has yet to approve the electronic form to be used to communicate document series to the Tax Authority (AT) and generate the ATCUD code.

Until this code is obtained, both SAF-T invoicing and QR code should indicate in the ATCUD field a "0" (zero) until being operationalized, as clarified by the AT on its website.

The absence of any reference to the QR code in the abovementioned Ministerial Order and Circular Letter may anticipate that in fact its adoption will be mandatory as from 01/01/2022.

Periodic VAT returns

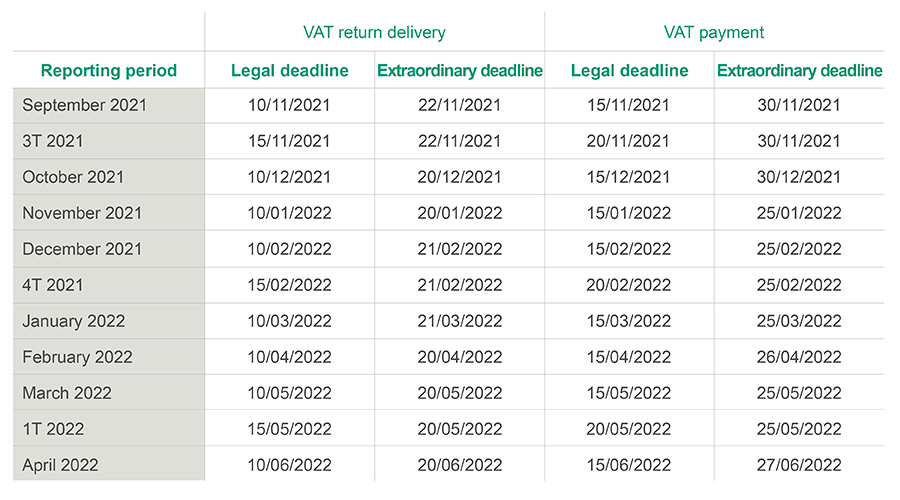

It has also been approved the extension of the following deadlines which, when they end on a weekend or public holiday, must be understood to end on the first following business day:

Other reporting obligations and PDF invoices

- Form Model 10: extension of the deadline for filing this return, for reporting income and respective withholdings that do not respect to employment income paid or made available to resident taxpayers, from 10 to 25/02/2022;

- Communication of inventories: new postponement of the use of the file structure approved by Ministerial Order no. 126/2019, of 2 May, now only for inventories of FY2022, to be communicated until 31/01/2023, and subsequent periods. Thus, the communication to be complied with in relation to the inventories of FY 2021, until 31/01/2022, must still be made through the structure currently in force as set out in Ministerial Order no. 2/2015, of 6 January, i.e. still without the inclusion of the valuation of inventories;

- PDF Invoices: new extension of the exceptional recognition of PDF invoices accepted as electronic invoices, for all tax purposes, from 31/12/2021, as provided for by Order no. 260/2021-XXII, of 27 July, to 30/06/2022.

Other pendent measures waiting for confirmation

Please note in addition there are still some measures that were included in the SBL 2022 which approval is also pendent:

- The postponement of the automatic submission of the IES/DA statement for the 2021 fiscal period through the submission of the SAF-T accounting file for the 2023 fiscal period, to be submitted in 2024;

- The reduction of the deadline to communicating the elements of invoices, other tax documents enabling the verification of goods or services and receipts, or the failure of issuance of these documents, from the 12th to the 5th day of the following month;

- The extension of the communication referred in the previous paragraph to non-resident taxpayers that have Portuguese VAT registrations from 2022 onwards;

- The five-day extension of the deadline for filing the periodic VAT return, as well as the deadline to pay corresponding VAT to the State, which would be extended, under monthly reports, from the 10th to the 15th day of the following second month and from the 15th to the 20th day of the following second month, respectively, and under quarterly reports from the 15th to the 20th day of the second month following the respective quarter and from the 15th to the 20th day of the second month following the same quarter;

- Extension of the exceptional application of the reduced VAT rate to respiratory protective masks and disinfectant gel.

Contacts