Social security contributions order for 2023 has been published

Labor Alert Spain

The order determines the maximum and minimum contribution bases and rates effective as of January 1, 2023. The maximum contribution base is set at €4,495.50 per month.

Order PCM/74/2023, of January 30, 2023, implementing the statutory provisions on social security, unemployment, business income protection, wage guarantee fund and occupational training contributions for 2023 was published in the Official State Gazette on January 31, 2023, with backdated effects to January 1, 2023.

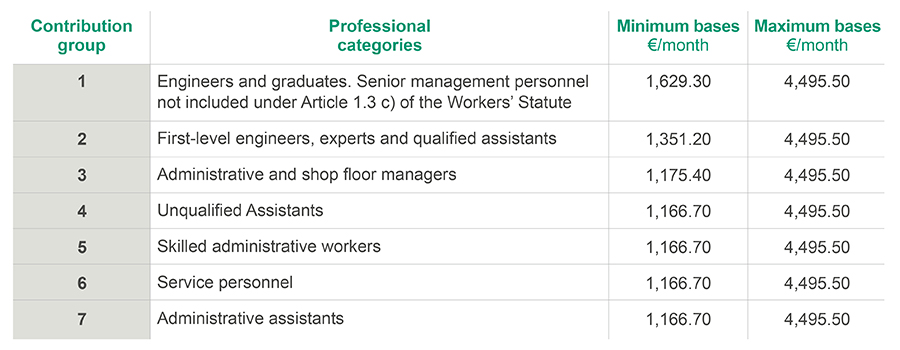

The upper and lower limits for contribution bases for fiscal year 2023 have been set as follows:

- The upper limit amounts to €4,495.50 per month.

- The lower limit amounts to the minimum wage in force at any given time, increased by the prorated amount of any amounts received by the worker in respect of periods of more than one month, and may not be less than €1,166.70 per month.

In particular, the maximum and minimum contribution bases for nonoccupational contingencies under the general system for each professional category are as follows:

The contribution bases will remain provisional until the minimum wage for fiscal year 2023 is approved, at which time they will be definitively approved by means of a new ministerial order.

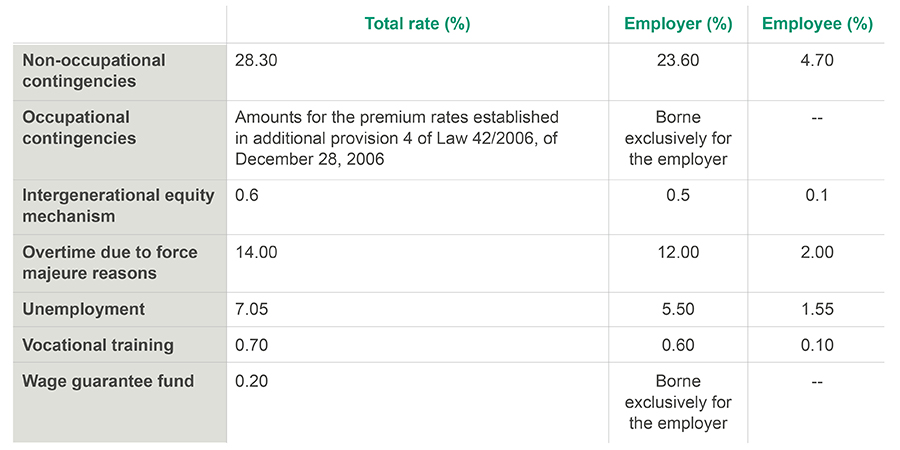

The contribution rates for nonoccupational contingencies under the general system will remain the same as to date, and the additional contribution relating to the intergenerational equity mechanism will be added.

The order also sets the minimum and maximum bases and contribution rates for groups included in the General Scheme with specialities and for the special Social Security schemes (agricultural workers, seafarers, artists, bullfighting professionals, etc. Of note in this regard are the changes introduced in relation to contributions to the special regime for self-employed workers or independent contractors, which will be based on net annual income obtained.

Contact