Order on 2022 social security contributions has been published

Spain Labor and Employment Alert

The order determines the maximum and minimum bases and rates effective as of January 1, 2022. The maximum contribution base amounts to €4,139.40.

On March 31, 2022, the Official State Gazette published Order PCM/244/2022, of March 30, 2022, implementing the statutory provisions on contributions for social security, unemployment, and business income protection, to the wage guarantee fund, and for vocational training, effective as of January 1, 2022.

The upper and lower limits on contribution bases for fiscal year 2022 have been set as follows:

- The upper limit amounts to €4,139.40 per month.

- The lower limit amounts to €1,166.70 per month.

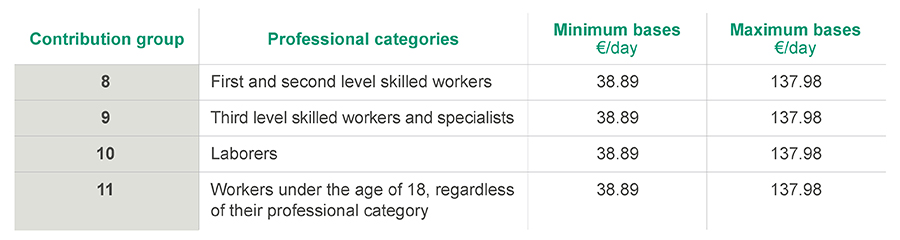

In particular, the maximum and minimum contribution bases for nonoccupational contingencies under the general system for each professional category are as follows:

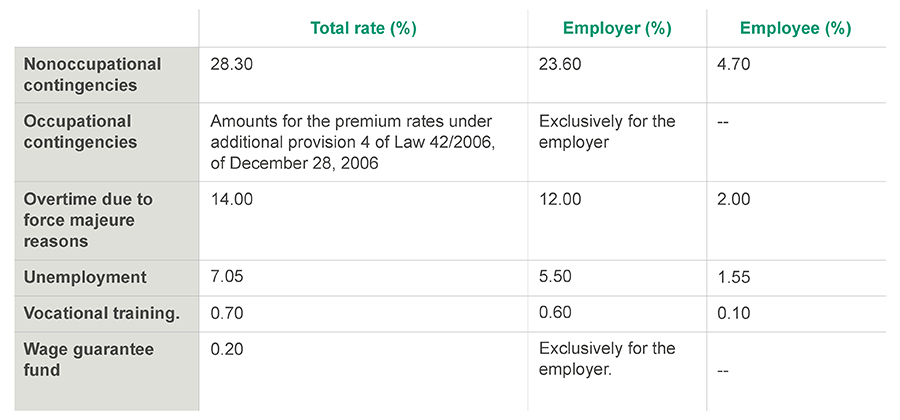

The contribution rates for nonoccupational contingencies under the general system have remained unchanged.

The order also sets the minimum and maximum contribution bases, as well as the contribution rates, for categories included in the general system with specific characteristics and for the special social security regimes (self-employed workers or independent contractors, salaried agricultural workers, maritime workers, domestic workers, artists, bullfighting professionals, etc.).

Moreover, a few new elements have been added with respect to the contribution order applicable to fiscal year 2021, including:

- A 75% reduction to employers’ social security contributions for nonoccupational contingencies during periods of temporary incapacity leave (sick leave) for any workers aged 62 or over.

- Rules on the contributions of workers who are subject to temporary reductions of working hours or temporary suspensions of contracts under article 47 bis of the Workers’ Statute (RED Mechanism for Employment Flexibility and Stability).

- An additional employer’s contribution amounting to €27.53 at the end of the contract term for fixed-term contracts for fewer than 30 days, except for workers included in the special system for salaried agricultural workers, domestic workers or coal mining employees. It will not be applicable either for contracts to substitute workers entitled to return to their jobs.

Any contribution differences arising after applying this order with respect to the contributions made since January 1, 2022, may be paid, without a surcharge, within a period ending on the last day of the sixth month following the month of its publication.

Contact