EU publishes amendments to VAT legislation affecting intra-Community trade

VAT Commentary

Call-off stock or consignment stock is specifically regulated, changes are introduced into chain sales, and requirements are laid down for applying the exemption to intra-Community supplies of goods.

As a prior step to approving the definitive VAT system for intra-Community trade, the European Commission proposed introducing various adjustments into the current legislation to simplify and harmonize certain rules, specifically those affecting call-off stock arrangements, chain sales, and certain aspects relating to the application and proof of the exemption for intra-Community transactions. Following their approval by the Council at the beginning of last week, these rules were published in the Official Journal of the EU on December 7, although the Members States are required to transpose them into national law so that they take effect from January 1, 2020.

Consignment sales

The first of the amendments refers to what the EU legislation calls “call-off stock”, which is simply certain sales of goods on consignment: specifically, the dispatch of goods to another Member State, by a seller not established in such State, to a warehouse that may be owned by the customer itself, so that the customer can acquire title to the goods at a later time depending on its needs, thereby speeding up their supply. It involves goods bound for a customer perfectly identified from the outset.

These arrangements entail the performance of an intra-Community transfer from the seller to the country of destination of the goods (with the subsequent obligations to identify and fulfill the formal obligations in such State) followed by a domestic supply once the customer acquires title to the goods.

However, some Member States had adopted measures to simplify these arrangements, which gave rise to differences in treatment which sometimes led to numerous problems in practice.

In order to ensure uniform treatment throughout the EU, this type of supply is now specifically regulated, so that the transaction will be treated as an intra-Community supply in the country of origin and an intra-Community acquisition in the country of destination. These taxable events will take place when the customer acquires title to the goods.

However, the rule requires recording the movement of the goods and the identifying particulars of the customer in the VAT register of certain intra-Community transactions and in the recapitulative statement – whose content will have to be adapted accordingly – so that the tax authorities know where the goods are.

If within twelve months, the transfer has not taken place or any of the conditions laid down by the rule for the simplification to apply are breached, the intra-Community transfer must be reported, with the implications that this entails. However, this obligation will not apply if, before the twelve-month period, the goods are re-transported to the State of origin or if a new customer is identified to whom they will be transferred in the State of destination, in both cases properly fulfilling the recording and reporting obligations laid down by the rule.

Chain sales

This amendment affects successive sales of a good where there is a single transportation of the good from the State of origin to the final customer in another Member State.

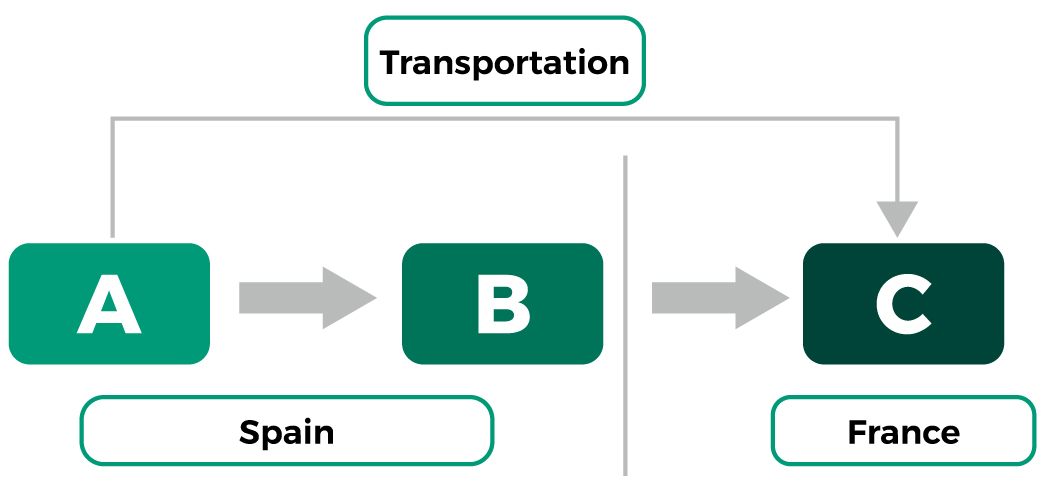

By way of example, imagine a sale of goods from A to B and successively from B to C in which the goods are transported from A (in Spain) to C (in France), as follows:

In recent years this type of transaction has given rise to several rulings by the Court of Justice of the EU on how to determine which supply the transportation should be ascribed to and which is therefore exempt.

The adoption of the Court’s criteria has not been easy in certain Member States, so it has been considered appropriate to regulate them specifically.

Therefore, in the example noted above, the transportation should be ascribed to the supply between A and B (which will therefore be exempt from VAT) unless B provides A with an identification number that that has been assigned to it in the State of origin of the goods – in our example, Spain – in which case the transportation should be ascribed to the second supply.

Exemption for supplies to another Member State

To be able to apply the exemption to what are commonly known as intra-Community supplies, it will be necessary to have the VAT identification number assigned to the customer by the Member State (this requirement, although included in the Spanish legislation, was not included in the Directive) and, moreover, the transaction must be properly reported in the recapitulative statement of intra-Community transactions. The aim therefore is to convert these formal requirements into substantive requirements to be able to apply the exemption.

The aim is also to harmonize the types of proof that taxable persons must have to evidence transportation to another Member State by means of a system of presumptions based on documents clearly defined in the legislation which may, however, be refuted by the tax authorities.

Transposition into national law

The new provisions must be transposed into national law with effect from January 1, 2020.

Contacts