COVID-19: Economic Support Facility – Questions and Answers

E.U. & Antitrust Commentary Portugal

In late March and early April, the European Commission ("EC") approved two state aid packages for Portugal, within the framework of Article 107 (3) (b) of the Treaty on the Functioning of the European Union (TFEU), namely decisions SA.56755 and SA.56873, respectively. The EC considers them necessary, appropriate and proportionate measures to remedy a serious disturbance in the economy of this Member State.

Applicants to the COVID-19 Economic Support Facility must take into account the short time frame available for submission.

The funds linked to this state aid will be handled by the entity SPGM Sociedade do Investimento S.A., and distributed to the businesses through the participating banks.

According to these EC decisions, these aids are not intended to address the viability, liquidity and solvency of credit institutions. Therefore, in order for the aid scheme to be properly implemented, the benefits it provides must be passed on as far as possible to its final beneficiaries (i.e. undertakings operating in Portugal belonging to the previously identified sectors and not receiving any immediate aid).

Access to state aids entails taking on new legal status by the beneficiaries. Any errors in the completion of applications or misinterpretation of the conditions attached to the granting of a state aid may result in the obligation to reimburse the amounts received, applying higher interest rates.

Overall, the state aids and their implementation measures at the national level can be summarised in the following terms:

1. What is the COVID-19 Economy Support Facility?

This is a credit facility intended to help businesses cope with the cash-flow needs arising from the COVID-19 epidemic.

2. What kind of companies is it address to?

SMEs and micro-enterprises with SME Certification, as well as Small Mid Cap and Mid Cap, located within the national territory and carrying out any of the activities making them eligible to each Specific Facility.

3. What priority order will be applied to applicant companies?

Applications will be answered on a strict “first come first served” basis. Thus companies taking longer to submit their applications will be penalised.

4. Are companies located abroad eligible?

No. The COVID-19 Economic Support Facility is exclusively targeted to firms based in the national territory.

5. What Specific Facilities are available?

The COVID-19 Economic Support Facility is broken down into 4 Specific Facilities.

-

“COVID-19 – Support to Catering Companies and Similar”;

-

“COVID-19 – Support to Tourist Companies”;

-

“COVID-19 – Support to Travel Agencies, Tourist Animation, Event Organizers and similar companies”*;

-

“COVID-19 – Support to Economic Activity”*.

*These facilities are already closed because their maximum amount has been reached (according to the information provided by the coordinating body of the Portuguese Mutual Guarantee system). However, since SA.56873 decision envisages a total amount of 13 billion for state aids, other support facilities targeted to the different business sectors may be launched in the course of the year depending on how the Portuguese economy picks up.

6. How do I know whether my company's business is covered by a Specific Facility?

A list of Economic Activity Codes (CAE) is established for each Specific Facility.

7. What are the eligibility criteria?

A company can benefit from this aid provided it meets all the following conditions:

-

Having recorded a positive net position in the last approved balance sheet;

-

Submitting a specific declaration where they commit to maintain permanent jobs until 31 December 2020, taking as a reference the confirmed number of such jobs as of 1 February 2020;

-

Having any unsettled incidents with banks or the mutual guarantee system (Sistema de Garantia Mútua) on the date of the contract (not counting the debts incurred in March 2020);

-

Submitting a declaration proving that the company is current on its obligations with the Tax Administration and Social Security;

-

Demonstrating that it was not in difficulty on 31 December 2019.

8. What if the company’s last approved balance sheet showed a negative net position?

It may also be eligible for the support facility, provided it has regularised this situation in an interim balance sheet at the date of application.

9. What if the company's activity started less than 24 months ago?

In this case, the positive net requirement on the last approved balance sheet does not apply.

10. Is the company eligible for aid since it started experiencing difficulties?

No. The requirement is that the net difficulties are a consequence of the COVID-19 epidemic, and that they did not exist on 31 December 2019. It is also important that, by then, the company was not in a situation where it lost half of its share capital or became insolvent, or that it did not benefit from any emergency aid or restructuring aid.

11. Does the fact that several employees of the company are in lay-off situation affect the company’s eligibility?

No. It is sufficient to demonstrate that the company applied the lay-off regime (Decree-Law no. 10-G/2020, of 26th March).

12. What kind of operations are eligible for this aid?

Only financing operations intended to cover cash needs.

13. What is the duration of the Specific Facilities?

The Specific Facilities will be in force until 31 December 2020.

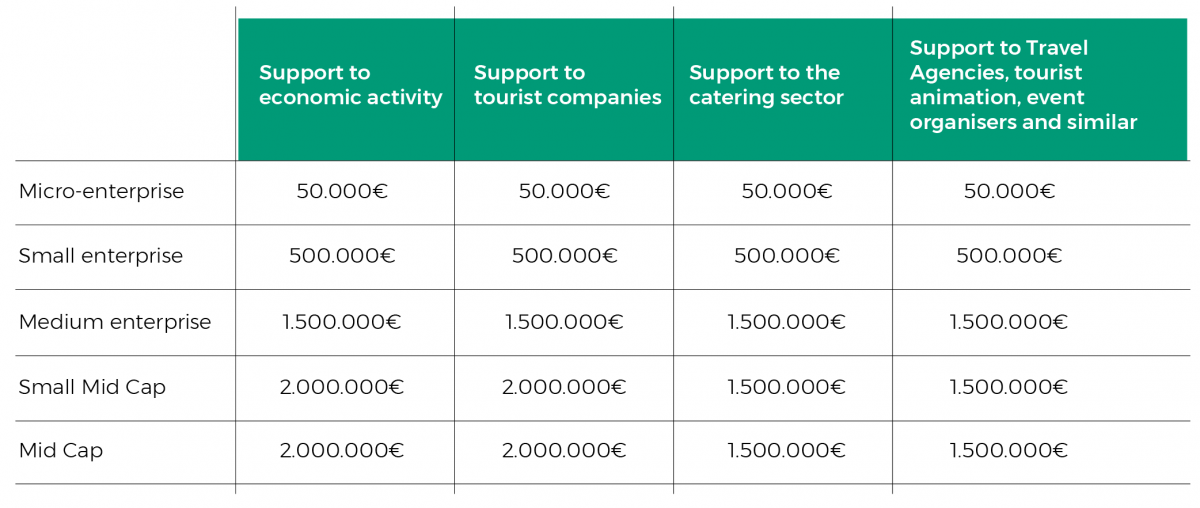

14. What are the maximum funding amounts per company?

15. Is it possible to transform part of the (owed) capital into direct grants?

Decision SA.56873 provides, until 31 December 2020, for the possibility that the Portuguese State may transform guaranteed loans into direct grants to companies, within the following limits: (i) €120,000 per company operating in the fishery and aquaculture, (ii) €100,000 per company engaged in the primary production of agricultural products and (iii) €800,000 for the remaining companies.

Contacts

-

+351 213 821 200