Spain: The contribution order for 2024 is published

The order establishes the maximum and minimum bases and contribution rates as of 1 January 2024. The maximum contribution base is set at 4,720.50 euros per month.

On 30 January 2024, Order PJC/51/2024 of 29 January was published in the “B.O.E.” (Official State Gazette) developing the legal rules on social security contributions, unemployment, protection in the event of termination of activity, the Wage Guarantee Fund and professional training for the financial year 2024, with effect from 1 January 2024.

The maximum and minimum contribution bases for 2024 are set as follows:

- The maximum base is EUR 4,720.50 per month.

- The minimum base is the minimum interprofessional wage in force at any given time, increased by one-sixth, unless expressly provided otherwise.

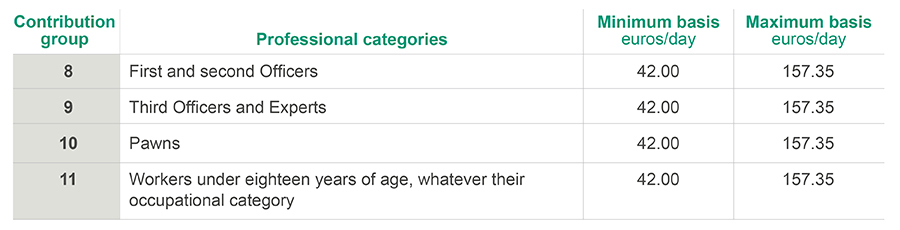

Specifically, the contribution to the General Scheme for common contingencies is limited for each group of professional categories by the following minimum and maximum bases:

Until the minimum interprofessional wage for 2024 is published in the Official State Gazette, the contribution bases will be provisional until a new ministerial order approves them definitively.

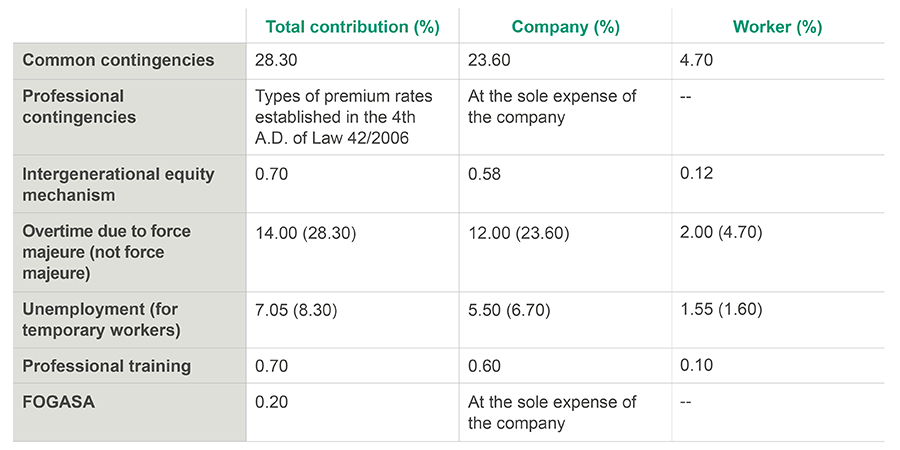

As for the contribution rates for common contingencies for the General Social Security Scheme, the rates applicable to date remain unchanged, with the additional contribution corresponding to the intergenerational equity mechanism being increased to 0.70%.

The Order also sets the minimum and maximum bases and contribution rates for groups included in the General Scheme with specialities and for the special social security schemes (agricultural workers, seafarers, artists, bullfighting professionals, etc.).

For self-employed workers, the contribution bases refer to net income in accordance with the first transitional provision of Royal Decree-Law 13/2022 of 26 July, which establishes a new contribution system for self-employed workers and improves protection in the event of cessation of activity, and the ninth transitional provision of Royal Decree-Law 8/2023 of 27 December.

Update: The minimum contribution bases have been updated in Order PJC/281/2024 collected in our publication of 1st April 2024.

Contact