Individual Income Tax Impact on Change of Tax Residence Status of Non-domiciled Individuals

China Tax Commentary

Due to the worldwide impact of COVID-19 Pandemic, some foreign expatriates working in China are unable to return to work in China or travel abroad for overseas work functions. The extended or shortened staying days in China affect the tax residence status of the foreign expatriates, which in turn, might result in different Individual Income Tax (IIT) payable in China.

The purpose of this article is to illustrate how the change of tax residence status would have an impact on the computation of Chinese IIT and draw the attention to the foreign expatriates who are in such circumstances, and their employers.

Distinction between Chinese tax resident and non-Chinese tax resident

An individual who has a domicile[1] in China or has no domicile in China (“Non-domiciled Individual”) but has stayed in China for more than 183 days in aggregate in a tax year (i.e. January 1 to December 31) shall be regarded as a Chinese tax resident.

On the other hand, a Non-domiciled Individual who has stayed in China for no more than 183 days in aggregate in a tax year shall be regarded as a non-Chinese tax resident.

As regards the computation of days in China, both arrival dates and departure dates would not be taken into consideration for tax residence status assessment purpose, e.g. if a Non-domiciled Individual comes to China on January 2 and leaves on January 4, he or she would be regarded as staying in China for one day (i.e. January 3). Neither January 2 nor January 4 would be taken into account for Chinese tax residence assessment purposes.

IIT liability for Non-domiciled Individual

According to PRC IIT Laws, the global income of a Chinese tax resident is subject to Chinese IIT, but a non-Chinese tax resident is only liable for the IIT on China-sourced income.

The Implementing Regulations of PRC IIT Laws further specify and supplement the IIT liability of a Non-domiciled Individual in China. A Non-domiciled Individual could be exempted from overseas sourced income not borne by Chinese entities, other economic organizations and individuals, provided that the Non-domiciled Individual lives in China for more than 183 days during a tax year (i.e. January 1 to December 31) but for no more than 6 consecutive years. In the case that the Non-domiciled Individual has a single trip out of China exceeding 30 days, the number of consecutive years shall be recounted from zero. Moreover, the global income of a Non-domiciled Individual living in China for 6 consecutive years without a single trip out of China exceeding 30 days is subject to Chinese IIT, provided that the Non-domiciled Individual stays in China for more than 183 days in the seventh tax year.

The IIT liability of Non- domiciled Individuals with no senior management roles is shown in the table below:

IIT computation for Non-domiciled Individual

The IIT calculation mechanisms for Chinese tax resident and non-Chinese tax resident are different. Consequently, a change of tax residence status could result in different IIT payable.

Furthermore, the below calculation formulas shall apply to the Non-domiciled Individual:

Chinese tax rules on Change of tax residence status for Non-domiciled Individual

Chinese IIT rules have specified that a Non-domiciled Individual shall make a pre-judgement on the tax residence status in China for the first monthly IIT filing based on his or her estimated days in China during a tax year (or the period specified by double taxation treaties) according to the available supporting documents, e.g. agreements:

- If a Non-domiciled Individual is estimated to be a Chinese tax resident, the monthly IIT calculation mechanism for Chinese tax resident shall be selected. Nevertheless, if the Non-domiciled Individual could not be qualified as a Chinese tax resident later, the withholding agent shall report to the competent tax authority between the date that non-Chinese tax residence status may be determined and January 15 of the following year, recalculate his or her IIT by applying the monthly IIT calculation mechanism for non-Chinese tax resident and settle the underpaid taxes or get tax refund;

- If a Non-domiciled Individual is estimated to be a non-Chinese tax resident, the monthly IIT calculation method for non-Chinese tax resident indicated shall apply. In the case that the Non-domiciled Individual has qualified as a Chinese tax resident later, monthly IIT calculation mechanism for non-Chinese tax resident shall continue to apply. Annual IIT filing for tax reconciliation is required to settle the underpaid taxes or get tax refund; or

- In the case that a Non-domiciled Individual is estimated to be in China for no more than 90 days (or 183 days under a double taxation treaty if the individual is the tax resident of the other jurisdiction) but stays in China for more than 90 (or 183) days later, the withholding agent has the obligation to report to the competent tax authority, recalculate his or her IIT and settle underpaid taxes in 15 days of the following month.

Case analysis for Javier and Maria

(a) Javier’s IIT in China

Javier, a Spanish national, works in China (excluding Hong Kong, Macau and Taiwan) as an engineer since January 1, 2020 and has no overseas functions. The only income of Javier is his monthly salary amounting to CNY 30,000 per month from his Chinese employer. Javier was estimated to stay in China for more than 183 days in 2020 at the beginning of the year and has filed as a tax resident. Due to the outbreak of COVID-19, Javier went back to Spain on February 1, 2020 and came back to China on August 31, 2020. His salary was reduced to CNY 25,000 per month since February 1, 2020.

Tax residence assessment

Javier would stay in China for no more than 183 (31 days for January, 30 days for September, 31 days for October, 30 days for November and 31 days for December) days in 2020. We assume that Javier is a Spanish tax resident in 2020 according to Spanish tax regulations. Please note that if the tax residence status in China is changed, it has to be assessed whether Javier is a tax resident of other jurisdictions.

IIT filing obligation and computation

Javier’s China-sourced income is paid and assumed by his Chinese employer. Consequently, the monthly salary income is taxable in China, regardless his absence in China for the period from February 1, 2020 to August 31, 2020.

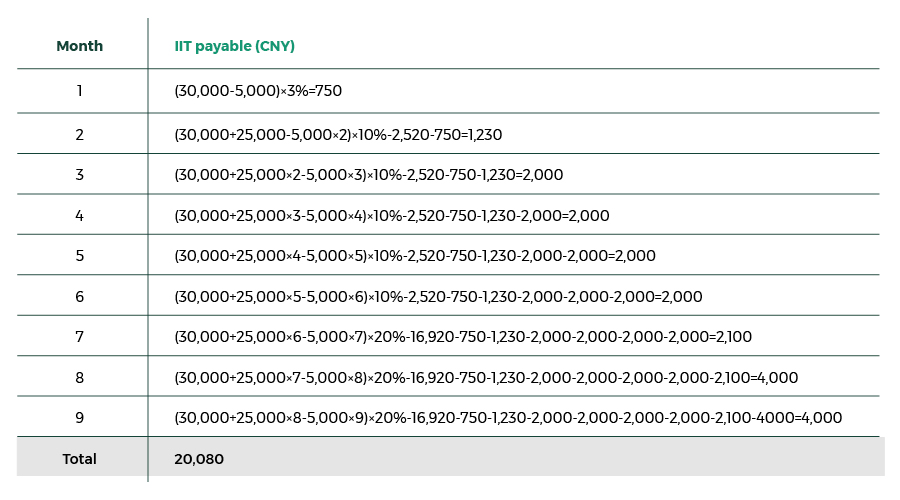

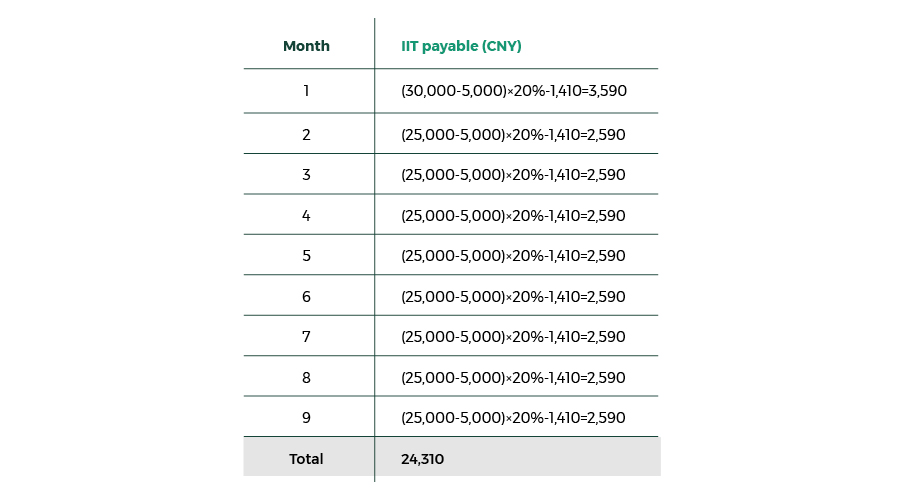

Considering that Javier is estimated to be a Chinese tax resident at the beginning of 2020, the monthly IIT calculation mechanism for Chinese tax resident shall be selected. The monthly IIT for Javier for the period from January 2020 to September 2020 is as follow (the employee’s portion of Chinese social security and the additional special deductions are not taken into consideration):

As Javier does not return to China until August 31, 2020, he has become a non-Chinese tax resident for 2020. In this regard, the withholding agent (i.e. the Chinese employer of Javier) shall report to the competent tax authority between the date that the non-Chinese tax residence status may be determined and January 15 of the following year, recalculate his IIT by applying the monthly IIT calculation mechanism for non-Chinese tax resident and settle the underpaid taxes or get tax refund (“Correction IIT Filings”). Assume that the Correction IIT Filings would be performed when the monthly IIT filing for September 2020 is finished, the calculation for Correction IIT Filings shall be as follow:

The withholding agent shall file and settle underpaid IIT amounted to CNY 4,230 (i.e. CNY 24,310-CNY 20,080) in the Correction IIT Filings. No late payment interest would be arisen by completing the Correction IIT Filings by January 15, 2021.

(b) Maria's IIT in China

Maria, a Spanish national, works in China (excluding Hong Kong, Macau and Taiwan) as a China sales manager since January 1, 2020 and has overseas functions. She has monthly salary amounting to CNY 40,000 per month from her Chinese and Spanish employers respectively. Maria was estimated to stay in China for no more than 183 days in 2020. However, due to the outbreak of COVID-19, Maria has been working in Spain from January 1, 2020 to May 30, 2020 and has returned to work in China on May 31, 2020. She will not leave China for the rest of 2020.

Tax residence assessment

Maria would stay in China for more than 183 days in 2020. Maria would become a Chinese tax resident in 2020. We assume Maria would not be a tax resident of other jurisdictions in 2020 according to the tax rules of other jurisdictions.

IIT filing obligation and computation

Maria’s China-sourced income from her Chinese employer is fully taxable in China. Maria’s Spanish-sourced income from her Spanish employer could be subject to IIT exemption by applying the double taxation treaty between China and Spain.

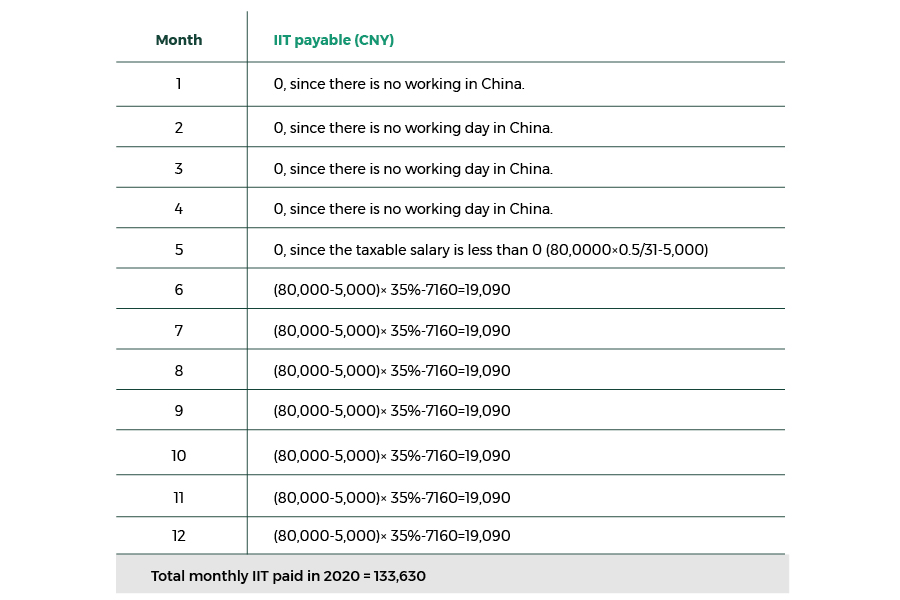

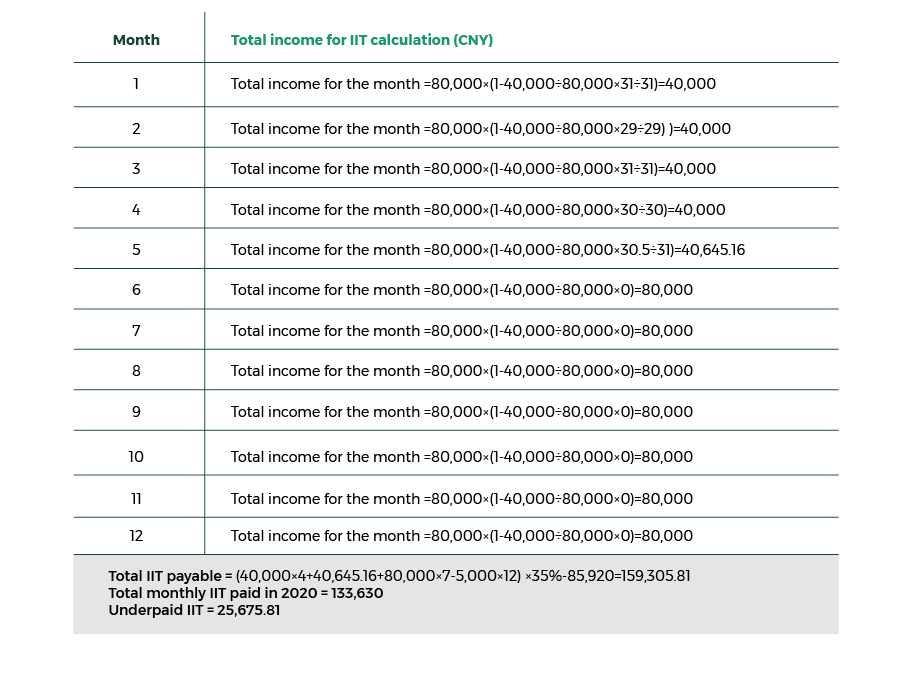

The monthly IIT calculation mechanism for non-Chinese tax resident shall be applied for Maria since January 2020 and could not be changed over the year. Formula 2 shall apply, which is calculated as follow (the employee’s portion of Chinese social security and the additional special deductions are not taken into consideration):

In addition to the monthly IIT filings, Maria shall perform annual IIT filing (applicable to Chinese tax residents) for tax reconciliation by applying Formula 3, i.e. adjust the tax residence status and settle the underpaid taxes or get tax refund, if any. The calculation for annual IIT filing shall be as follows:

Maria shall file and settle underpaid IIT amounted to CNY 25,675 in the annual IIT filing. No late payment interest would arise if the annual filing may be completed between March 1, 2021 and June 30, 2021.

Garrigues insights

For the Non-domiciled Individual working in China, we highly recommend to review the estimated staying days in China in 2020. If the Non-domiciled Individual is not a Chinese tax resident, the Non-domiciled Individual shall check the tax residence of other jurisdictions, especially the jurisdiction of origin. If there is a change of tax residence status in China during a tax year, please consult with your human resource department, the competent tax authority or your tax advisor to confirm if there is an adjustment required for the IIT payable and the corresponding adjustment procedure based on the local practices of the competent tax authority.

* This publication contains general information, without constituting a professional opinion or legal advice.

[1] An individual habitually resides in China due to the household registration, family or economic relationship.

Contacts

-

+34 95 207 55 25