The European Union and Spain are approving measures to promote the development of start-ups which play a part in helping combat COVID-19 and the repercussions of the pandemic. Tax incentives intended to promote activities of this type linked to technological innovation are also envisaged.

Tourism is one of the most important sectors in the Spanish economy and is also one of the fields in which digitalization is occurring fastest and with the greatest impact. The technological transition in the tourism sector has been speeded up in response to the current COVID-19 health crisis, the impact of which is worldwide and has hit tourism particularly hard. In the short term, at least, this is a great opportunity for start-ups which can produce answers and solutions to the new problems and challenges which are emerging, thanks to their capacity for adaptation and reinvention.

It is clear that technology will have a key role to play in this respect - in the areas of health, the economy and the management of tourist destinations[1] specifically - by redefining products and experiences which are suited to the needs of a new kind of consumer and to the changes in the way the markets behave. It will be possible, through the use of digital tools, to implement security measures and health methods for the tourism sector, develop digital applications to be implemented in that sector and, in general, develop strategies whereby confidence in the tourism industry can be rebuilt. The possibility of deciding on the basis of data, the use of artificial intelligence, virtual and augmented reality or geolocation, among other factors, will help travelers regain their trust in the industry.

In this respect, start-ups will make the latest technological advances available to society very soon, and investment in their projects by private equity funds, among others, could guarantee that they are actually utilized in bringing about a recovery of tourism, for the good of companies and countries generally, given the numerous economic sectors which benefit from tourism. Also to be noted is the importance of such investment in promoting innovation and improvement of the opportunities for the growth of start-ups, enabling them to be competitive in the market and, given the current scenario, to overcome the COVID-19 crisis, bearing in mind that the obtaining of funding is one of the major challenges facing start-ups in these circumstances.

Public sector entities are playing their part in this respect. In Europe, the European Commission has set up a fund aimed at all those start-ups and small businesses developing technologies and innovations which help in the treatment, testing, monitoring and other aspects of COVID-19 and are used exclusively in the search for solutions with which to combat the pandemic. The Alto Comisionado para España Nación Emprendedora (High Commission to promote Spain as an Entrepreneurial Nation) has also clearly set out the Government's priorities in relation to entrepreneurship, which include developing the capacity to attract investment and promoting the role of the public sector in the entrepreneurial environment.

On the other hand, the European Investment Fund (a subsidiary of the EIB Group) and Axis, a private equity management company wholly owned by ICO, have set up a new investment fund called ‘Business Angels Fund - EAF Spain II’, which has been allocated forty million euros for the financing of innovative businesses in Spain which are in the start-up phase[2].

Finally, the tax incentives made available to promote activities of this kind linked to technological innovation are not to be overlooked. Although the trend over recent years has been a continuous elimination of incentives of this type, the legislature has continued to promote engagement in research and development and technological innovation activities by offering major tax savings in the form of Corporate Income Tax credits.

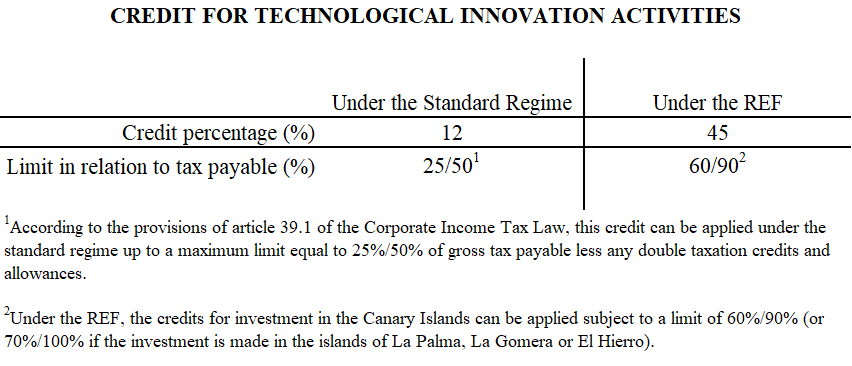

It is possible to recover up to 12% of the cost of investments made in projects which qualify as technological innovation, and there is even the possibility of monetizing any unused credits generated, subject to compliance with certain requirements in terms of timing and reinvestment commitments.

And for technological innovation projects which are effectively carried out in the Canary Islands - where the tourism industry has been seriously damaged by the health crisis - , the tax incentives available are considerably higher under the Canary Islands Economic and Tax Regime (REF), which envisages a credit equal to 45% of the investment cost incurred in projects which qualify as technological innovation.

The system of credits described is summarized in the following table:

In short, technological innovation can be, for start-ups, not only an effective means of rebuilding confidence in the tourism sector; it can also enable them to obtain major tax savings.

[1] In response to this situation, the World Tourism Organization (WTO), supported by the World Health Organization (WHO), launched its “Healing Solutions for Tourism Challenge”, the objective of this worldwide initiative being to identify the most innovative start-ups and the most disruptive solutions in the areas of health, the economy and destination management. The projects selected as finalists include the solution known as “SmartOccupancy”, developed by the Spanish company Checkpoint Systems España, S.L.U., whereby occupancy can be managed in real time.

[2] This fund will finance business angels which invest in Spanish technology companies whose activities are highly innovative and which are at the start-up stage, and will help increase the capacity for investment of business angels and other non-institutional investors which invest in SMEs.